Tax Reform for Acceleration and Inclusion

Gov’t can mitigate oil price hikes by scrapping fuel taxes

August 8, 2023

The Marcos Jr administration can moderate the impact of oil price hikes on millions of Filipinos by scrapping excise and value-added taxes for petroleum products.

Use ₱133.9-billion TRAIN revenues for ayuda – IBON

August 14, 2021

The Duterte administration can use revenue generated by its regressive TRAIN law to fund emergency cash assistance. TRAIN’s new taxes increased the prices for goods and services consumed by the majority poor Filipinos even amid the pandemic and the revenues can be used productively while the law remains.

IBON Executive Director on TRAIN and CREATE

July 26, 2021

Why make the poor pay for COVID-19 response?

May 24, 2020

COMMENTARY

There’s more than enough money for all the COVID-19 response we need – the Duterte administration just has to take the side of the people and stop being so scared of the rich.

IBON questions CITIRA job creation claims

October 3, 2019

Research group IBON said the Department of Finance’s (DOF) claim of over a million jobs to be created by corporate income tax cuts under the proposed Corporate Income Tax and Incentives Rationalization Act (CITIRA) is imaginary. The group said that the DOF is hyping job creation to justify implementation of regressive tax measures. CITIRA will […]

How do the senatoriables fare?: TRAIN LAW

March 22, 2019

WHO’S SCARED TO DEBATE THE TRAIN LAW? The TRAIN Law implemented since 2018 increased the tax burden on tens of millions of the poorest Filipinos while lowering taxes on higher income families including the country’s richest. Some lawmakers have reconsidered but others still defend the indefensible. Most aspiring senators are justifiably critical. Who’s who?

Fuel more expensive due to TRAIN

February 18, 2019

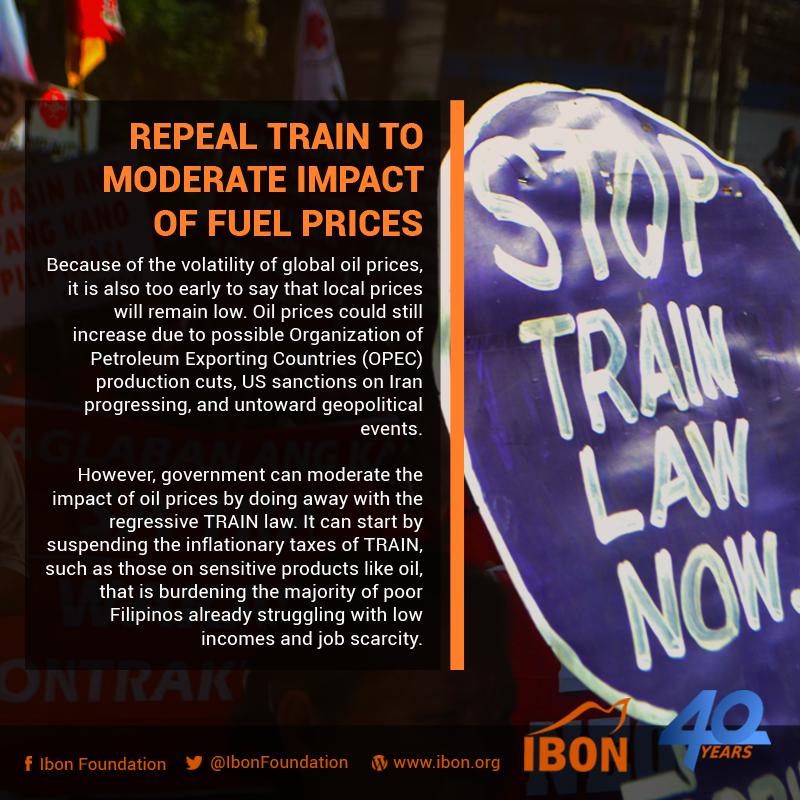

Repeal TRAIN to moderate impact of fuel prices

December 13, 2018

Read more: Despite rollbacks, TRAIN makes fuel more expensive–IBON

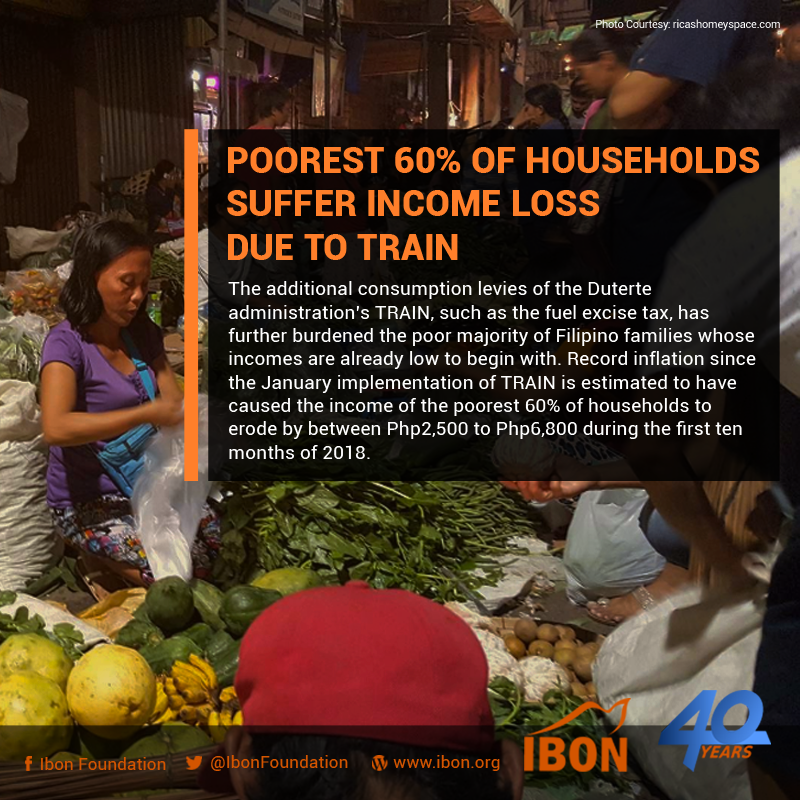

Poorest 60% of households suffer income loss due to TRAIN

December 13, 2018

Read more: Despite rollbacks, TRAIN makes fuel more expensive–IBON