Comprehensive Tax Reform Program

Double taxes on oil show govt’s lack of concern for poor – IBON

February 23, 2018

Slapping additional taxes on oil products makes the Tax Reform for Acceleration and Inclusion (TRAIN) law anti-poor, research group IBON said. Contrary to the argument that the new law is ‘fair’, the group said that these oil taxes should be scrapped for the benefit of millions of Filipinos who will otherwise continue to suffer the […]

Downplaying the price impact of TRAIN dishonest and insensitive–IBON

January 8, 2018

Petroleum excise taxes proven to be very inflationary in the past The administration persistently downplays certain increases in the prices of goods and services, research group IBON’s Executive Director Sonny Africa said. This is dishonest and insensitive to the burden that the Tax Reform for Acceleration and Inclusion (TRAIN) imposes on the poor to avoid […]

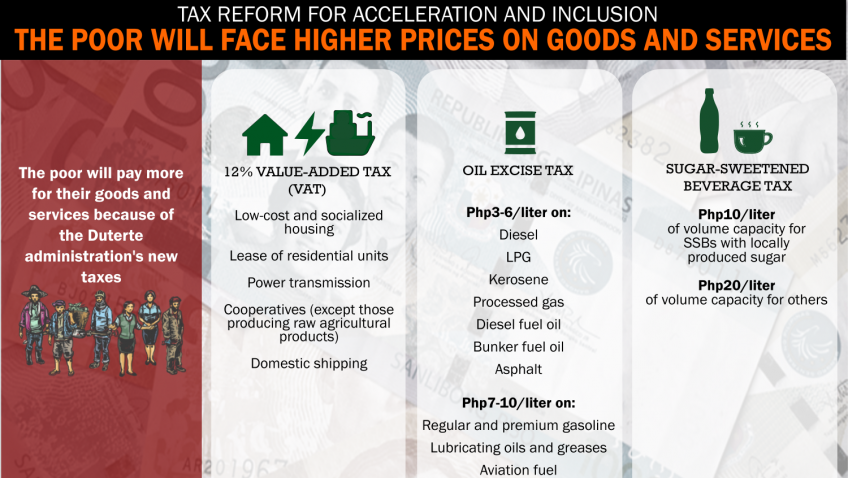

Real wage falling, higher taxes imminent (with TRAIN Infographic #4)

September 19, 2017

Though welcome, the recent wage hike in the National Capital Region (NCR) does not increase the minimum wage earners’ purchasing power. The real value of the minimum wage is even falling while the people face higher taxes under government’s proposed tax reforms, said the group. The NCR Regional Wage Board recently announced a Php21 wage hike, […]

IBON: DOF insistence on its tax package confirms anti-poor, pro-rich Dutertenomics

September 15, 2017

Research group IBON said that the Department of Finance’s (DOF) resistance to even minor changes in its proposed tax reform program confirms the anti-poor and pro-rich character of the Duterte administration’s economic policies. The Senate Ways and Means Committee proposed minor changes to shift some tax burden from the poor to the rich at its […]

Majority not in favor of tax reform proposals – IBON Survey

September 13, 2017

The latest survey of research group IBON showed that majority of Filipinos do not approve of almost all proposals under the first package of the Duterte administration’s proposed tax reform program. Survey respondents were informed that the government has a proposed tax reform package. They were presented with a list of some of the tax […]

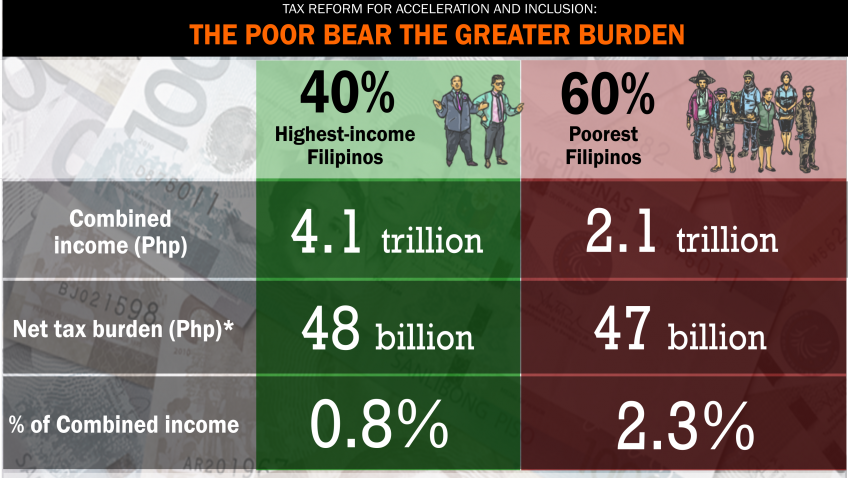

Under TRAIN, the poor bear the greater burden (TRAIN Infographic #2)

September 7, 2017

Under the tax ‘reform’ package which is currently being deliberated by the Philippine Senate, the poorest 60 million Filipinos will pay Php47.0 billion in additional taxes next year which is 2.3% of their combined family income of some Php2.0 trillion. The highest income 40%, meanwhile, will pay Php47.6 billion which is only 0.8% of their total family […]

Buwis(et)! DOF’s Top 5 Tax Reform Lies

June 20, 2017

By Sonny Africa IBON FEATURES — The Tax Reform for Acceleration and Inclusion Act (TRAIN), the first part of the Duterte administration’s Comprehensive Tax Reform Program (CTRP), has hurdled the House of Representatives (HOR) and is up for deliberations at the Senate. The Department of Finance (DOF) targets approval of TRAIN, or House Bill No. […]